LAEDC provides the following detail on business / employer relief in the federal Cares Act. Here are the details:

Information is still being analyzed, and while LAEDC is making reasonable efforts to verify accuracy, it is important that readers source information from official sources before making decisions.

Coronavirus: Q&A related to businesses

Coronavirus: Q&A related to businesses

Q&A for businesses (pdf)

- Small businesses

- Small Business Debt Relief Program

- Economic Injury Disaster Loans & Emergency Economic Injury Grants

- Counseling and training

- Airlines

What support is there for small businesses?

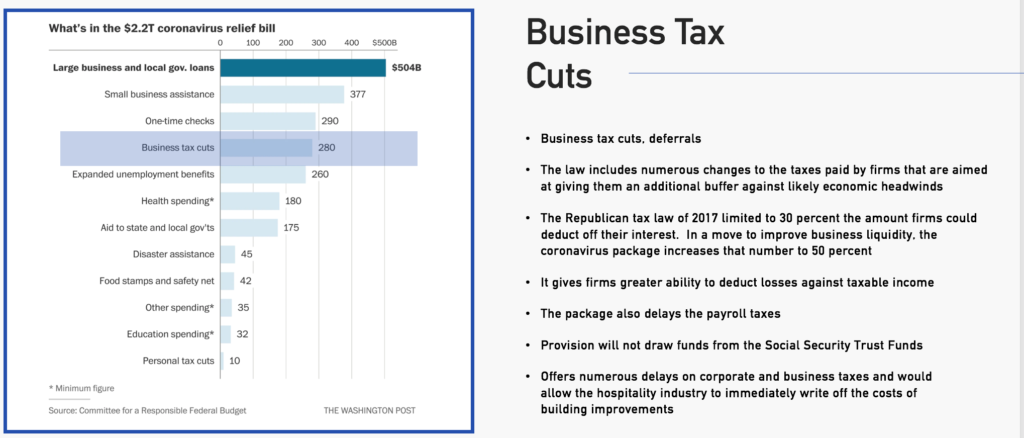

Refundable tax credits are available for private-sector employers that are required to offer coronavirus related paid leave to employees. IRS will be posting information soon on these credits on its website (www.irs.gov), including information on how to obtain advance payment of these credits.

The employer side of certain payroll taxes are deferred through the end of 2020. Deferred taxes will not become due until end of 2021 and end of 2022, with 50% of the liability being paid at each date. Any business that does not have a loan forgiven under the new SBA Paycheck Protection Program is eligible for the payroll tax deferral.

An employee retention tax credit is available for struggling businesses that are not eligible or choose not to participate in the new SBA Paycheck Protection Program. Any business that has been forced to fully or partially suspend operations, or that has seen a significant drop in revenues is eligible for a 50-percent credit for wages paid to furloughed or reduced-hour employees. For businesses with 100 employees or less, the credit is based on all wages paid, regardless of whether an employee is furloughed. There is an overall limit on wages per employee of $10,000. The credit can be claimed against the business’s quarterly payroll tax liability and is fully refundable to the extent of excess. There will also be options to receive advance payments. Small business owners should lookout for information at IRS.gov and talk to their payroll service provider, as applicable.

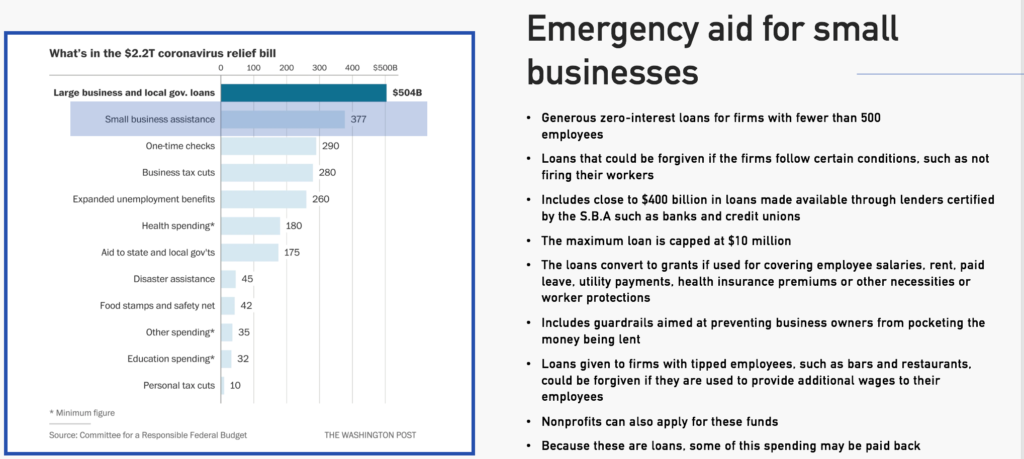

$350 billion is made available for a new Small Business Administration Paycheck Protection Program (PPP). The program would provide cash-flow assistance through 100 percent federally guaranteed loans to employers who maintain their payroll during this emergency. If employers maintain their payroll, the loans would be forgiven, which would help workers remain employed, as well as help affected small businesses and our economy to snap-back quicker after the crisis. PPP has a host of attractive features, such as forgiveness of up to 8 weeks of payroll based on employee retention and salary levels, no SBA fees and at least six months of deferral with maximum deferrals of up to a year. Small businesses and other eligible entities will be able to apply if they were harmed by COVID-19 between February 15, 2020 and June 30, 2020. This program is would be retroactive to February 15, 2020, in order to help bring workers who may have already been laid off back onto payrolls. Loans are available through June 30, 2020.

$17 billion is available for immediate relief to small businesses with non-disaster SBA loans, in particular 7(a), 504, and microloans. Under it, SBA will cover all loan payments on these SBA loans, including principal, interest, and fees, for six months. This relief will also be available to new borrowers who take out loans within six months of the President signing the bill into law.

The CARES Act creates a new SBA Economic Injury Emergency Grant Program. These grants provide an emergency advance of up to $10,000 to small businesses and private non-profits harmed by COVID-19 within three days of applying for an SBA Economic Injury Disaster Loan (EIDL). To access the advance, you must first apply for an EIDL and then request the advance. The advance does not need to be repaid under any circumstance, and may be used to keep employees on payroll, to pay for sick leave, meet increased production costs due to supply chain disruptions, or pay business obligations, including debts, rent and mortgage payments.

What type of assistance will independent contractors be eligible for?

Refundable tax credits are available for independent contractors who would have qualified for coronavirus related paid leave if they were employees. IRS will be posting information soon on these credits on its website (www.irs.gov), including information on how to claim these credits.

50 percent of certain self-employment taxes are deferred through the end of 2020. Deferred taxes will not become due until end of 2021 and end of 2022, with 50% of the liability being paid at each date.

Independent contractors are also eligible for assistance through the Small Business Administration’s new Paycheck Protection Program and Economic Injury Emergency Grant Program.

What assistance is there for nonprofits?

The employer side of certain payroll taxes are deferred through the end of 2020. Deferred taxes will not become due until end of 2021 and end of 2022, with 50% of the liability being paid at each date. Any business that does not have a loan forgiven under the new SBA Paycheck Protection Program is eligible for the payroll tax deferral.

Certain tax-exempt organizations that have been forced to fully or partially suspend operations, or that have seen a significant drop in revenues are eligible for a 50-percent credit for wages paid to furloughed or reduced-hour employees. Organizations that participate in the SBA Paycheck Protection Loan Program are not eligible for the credit. For organizations with 100 employees or less, the credit is based on all wages paid, regardless of whether an employee is furloughed. There is an overall limit on wages per employee of $10,000. The credit can be claimed against the organization’s quarterly payroll tax liability and is fully refundable to the extent of excess. There will also be options to receive advance payments.

501(c)(3) nonprofit organizations, along with small businesses, 501(c)(19) veterans organizations, and tribal businesses, are eligible to apply for the Small Business Administration’s Paycheck Protection Program. Through this program, a nonprofit organization can apply to an SBA-approved lender for a loan of up to 250% of your average monthly payroll costs to cover eight weeks of payroll as well as help with other expenses like rent, mortgage payments, and utilities. The maximum loan amount is $10 million. This loan can be forgiven based on maintaining employee and salary levels. For any portion of the loan that is not forgiven, the terms include a maximum term of 10 years, a maximum interest rate of 4 percent. Nonprofit organizations will be able to apply if they were harmed by COVID-19 between February 15, 2020 and June 30, 2020. To be eligible, nonprofit organizations must have fewer than 500 employees, or more if SBA’s size standards for the non-profit allows, and comply with the SBA’s affiliation rules for nonprofits. This program is retroactive to February 15, 2020, in order to help bring workers who may have already been laid off back onto payrolls. Loans are available through June 30, 2020.

A provision in the CARES package would authorize a program to allow any mid-sized nonprofit between 500 and 10,000 employees to get access to quick, low cost, government guaranteed credit through their local lender or financial institution. These organizations need cash now and so this program is set up to get money quickly in the hands of those who need it in order to preserve workforce during the COVID-19 health emergency.

The Treasury Department and Federal Reserve will have a degree of flexibility in designing the new program, but the expectation is for loan terms to last for no more than five years and to cover up to 100% of payroll over the previous 180 days, or 50% of revenues for the past year, for eligible organizations. Underwriting requirements should be kept simple, based on employer size, creditworthiness as of January 2020, and the ability to produce recent tax returns or audited financial statements. The legislation prescribes that the loans must carry an interest rate of no greater than 2% and to provide forbearance on principal and interest for at least the first 6 months. Borrowers will also be required to protect workers. Any loan recipient will have to attest that they’ll use the money to keep workers employed — at least to 90% of their payroll — and keep workers paid at close to full compensation and benefits. Borrowers will also commit to rehiring their workforce back to preexisting levels upon the end of the COVID-19 health emergency.

The most efficient way to deliver fast credit to eligible organizations is through existing relationships with local lenders. Under the program, any qualified organization should be able to receive financing at a local bank, credit union, CDFI, or qualified nonbank lender.

What types of businesses and entities are eligible for a PPP loan?

• Businesses and entities must have been in operation on February 15, 2020.

• Small business concerns, as well as any business concern, a 501(c)(3) nonprofit organization, a 501(c)(19) veterans organization, or Tribal business concern described in section 31(b)(2)(C) that has fewer than 500 employees, or the applicable size standard in number of employees for the North American Industry Classification System (NAICS) industry as provided by SBA, if higher.

• Individuals who operate a sole proprietorship or as an independent contractor and eligible self-employed individuals.

• Any business concern that employs not more than 500 employees per physical location of the business concern and that is assigned a North American Industry Classification System code beginning with 72, for which the affiliation rules are waived.

• Affiliation rules are also waived for any business concern operating as a franchise that is assigned a franchise identifier code by the Administration, and company that receives funding through a Small Business Investment Company

What are SBA affiliation rules?

Affiliation rules become important when SBA is deciding whether a business’s affiliations preclude them from being considered “small.” Generally, affiliation exists when one business controls or has the power to control another or when a third party (or parties) controls or has the power to control both businesses. Please see this resource for more on these rules and how they can impact your business’s eligibility.

What types of non-profits are eligible for the SBA PPP assistance?

In general, 501(c)(3) and 501(c)(19) non-profits with 500 employees or fewer as most non-profit SBA size standards are based on employee count, not revenue. You can check here.

How is the PPP loan size determined?

Depending on your business’s situation, the loan size will be calculated in different ways (see below). The maximum loan size is always $10 million.

• If you were in business February 15, 2019 — June 30, 2019: Your max loan is equal to 250 percent of your average monthly payroll costs during that time period. If your business employs seasonal workers, you can opt to choose March 1, 2019 as your time period start date.

• If you were not in business between February 15, 2019 — June 30, 2019: Your max loan is equal to 250 percent of your average monthly payroll costs between January 1, 2020 and February 29, 2020.

• If you took out an Economic Injury Disaster Loan (EIDL) between February 15, 2020 and June 30, 2020 and you want to refinance that loan into a PPP loan, you would add the outstanding loan amount to the payroll sum.

What costs are eligible for payroll under the PPP?

• Compensation (salary, wage, commission, or similar compensation, payment of cash tip or equivalent)

• Payment for vacation, parental, family, medical, or sick leave

• Allowance for dismissal or separation

• Payment required for the provisions of group health care benefits, including insurance premiums

• Payment of any retirement benefit

• Payment of State or local tax assessed on the compensation of employees

What costs are not eligible for payroll under the PPP?

• Employee/owner compensation over $100,000

• Taxes imposed or withheld under chapters 21, 22, and 24 of the IRS code

• Compensation of employees whose principal place of residence is outside of the U.S

• Qualified sick and family leave for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act

What are allowable uses of loan proceeds with a PPP loan?

• Payroll costs (as noted above)

• Costs related to the continuation of group health care benefits during periods of paid sick, medical, or family leave, and insurance premiums

• Employee salaries, commissions, or similar compensations (see exclusions above)

• Payments of interest on any mortgage obligation (which shall not include any prepayment of or payment of principal on a mortgage obligation)

• Rent (including rent under a lease agreement)

• Utilities

• Interest on any other debt obligations that were incurred before the covered period

What are the loan term, interest rate, and fees for a PPP loan?

For any amounts not forgiven, the maximum term is 10 years, the maximum interest rate is 4 percent, zero loan fees, zero prepayment fee (SBA will establish application fees caps for lenders that charge).

How is the forgiveness amount calculated under PPP?

Forgiveness on a covered loan is equal to the sum of the following payroll costs incurred during the covered 8 week period compared to the previous year or time period, proportionate to maintaining employees and wages (excluding compensation over $100,000):

Payroll costs plus any payment of interest on any covered mortgage obligation (not including any prepayment or payment of principal on a covered mortgage obligation) plus any payment on any covered rent obligation plus and any covered utility payment.

How do I get forgiveness on my PPP loan?

You must apply through your lender for forgiveness on your loan. In this application, you must include:

• Documentation verifying the number of employees on payroll and pay rates, including IRS payroll tax filings and State income, payroll and unemployment insurance filings

• Documentation verifying payments on covered mortgage obligations, lease obligations, and utilities.

• Certification from a representative of your business or organization that is authorized to certify that the documentation provided is true and that the amount that is being forgiven was used in accordance with the program’s guidelines for use.

What happens after the forgiveness period for a PPP loan?

Any loan amounts not forgiven is carried forward as an ongoing loan with max terms of 10 years, at 4% max interest. Principal and interest will continue to be deferred, for a total of 6 months to a year after disbursement of the loan. The clock does not start again.

Can I get more than one PPP loan?

No, an entity is limited to one PPP loan. Each loan will be registered under a Taxpayer Identification Number at SBA to prevent multiple loans to the same entity.

What kind of lender can I get a PPP loan from?

All current SBA 7(a) lenders are eligible lenders for PPP. The Department of Treasury will also be in charge of authorizing new lenders, including non-bank lenders, to help meet the needs of small business owners.

How does the PPP loan coordinate with SBA’s existing loans?

Borrowers may apply for PPP loans and other SBA financial assistance, including Economic Injury Disaster Loans (EIDLs), 7(a) loans, 504 loans, and microloans, and also receive investment capital from Small Business Investment Corporations (SBICs).

How does the PPP loan work with the temporary Emergency Economic Injury Grants and the Small Business Debt Relief program?

Emergency Economic Injury Grant recipients and those who receive loan payment relief through the Small Business Debt Relief Program may apply for and take out a PPP loan. Refer to those sections for more information.

SMALL BUSINESS DEBT RELIEF PROGRAM

Which SBA loans are eligible for debt relief under this program?

7(a) loans not made under the Paycheck Protection Program (PPP), 504 loans, and microloans. Disaster loans are not eligible.

How does debt relief under this program work with a PPP loan?

Borrowers may separately apply for and take out a PPP loan, but debt relief under this program will not apply to a PPP loan.

How do I know if I’m eligible for a 7(a), 504, or microloan?

In general, businesses must meet size standards, be based in the U.S., be able to repay, and have a sound business purpose. To check whether your business is considered small, you will need your business’s 6-digit North American Industry Classification System (NAICS) code and 3-year average annual revenue. Each program has different requirements, see https://www.sba.gov/funding-programs/loans for more details.

What is a 7(a) loan and how do I apply?

7(a) loans are an affordable loan product of up to $5 million for borrowers who lack credit elsewhere and need access to versatile financing, providing short-term or long-term working capital and to purchase an existing business, refinance current business debt, or purchase furniture, fixtures and supplies. In the program, banks share a portion of the risk of the loan with SBA. There are many different types of 7(a) loans, you can visit this site to find the one that’s best for you. You apply for a 7(a) loan with a bank or a mission-based lender. SBA has a free referral service tool called Lender Match to help find a lender near you.

What is a 504 loan and how do I apply?

The 504 Loan Program provides loans of up to $5.5 million to approved small businesses with long-term, fixed-rate financing used to acquire fixed assets for expansion or modernization. It is a good option if you need to purchase real estate, buildings, and machinery. You apply through a Certified Development Company, which is a nonprofit corporation that promotes economic development. SBA has a free referral service tool called Lender Match to help find a lender near you.

What is a microloan and how do I apply?

The Microloan Program provides loans up to $50,000 to help small businesses and certain not-for-profit childcare centers to start up and expand. The average microloan is about $13,000. These loans are delivered through mission-based lenders who are also able to provide business counseling. SBA has a free referral service tool called Lender Match to help find a microlender near you.

I am unfamiliar with SBA loans, can anyone help me apply?

Yes, SBA resource partners are available to help guide you through the loan application process. You can find your nearest Small Business Development Center (SBDC) or Women’s Business Center here.

ECONOMIC INJURY DISASTER LOANS & EMERGENCY ECONOMIC INJURY GRANTS

Are businesses and private non-profits in my state eligible for an EIDL related to COVID-19?

Yes, those suffering substantial economic injury in all 50 states, DC, and the territories may apply for an EIDL.

What is an EIDL and what is it used for?

EIDLs are lower interest loans of up to $2 million, with principal and interest deferment available for up to 4 years that are available to pay for expenses that could have been met had the disaster not occurred, including payroll and other operating expenses.

Who is eligible for an EIDL?

• Small business concerns (including sole proprietorships, with or without employees)

• Independent contractors

• Cooperatives and employee owned businesses

• Private non-profits

• Tribal small businesses

Small business concerns and small agricultural cooperatives that meet the applicable size standard for SBA are also eligible, as well as most private non-profits of any size. See below for more info on size standards.

My private non-profit is not a 501(c)(3). Is it still eligible for an EIDL and a grant?

Yes, if you are a private non-profit with an effective ruling letter from the IRS, granting tax exemption under sections 501(c), (d), or (e) of the Internal Revenue Code of 1954, or if you can provide satisfactory evidence from the State that the non-revenue producing organization or entity is a non-profit one organized or doing business under State law. However, a recipient that is principally engaged in teaching, instructing, counseling, or indoctrinating religion or religious beliefs, whether in a religious or secular setting, or primarily engaged in political or lobbying activities is not eligible to receive an EIDL. If you are uncertain whether you qualify, please consult with legal counsel to determine whether your organization meets program criteria.

Who is eligible for an Emergency Economic Injury Grant?

Those eligible for an EIDL and who have been in operation since January 31, 2020, when the public health crisis was announced.

How long are Emergency Economic Injury Grants available?

January 31, 2020 — December 31, 2020. The grants are backdated to January 31, 2020 to allow those who have already applied for EIDLs to be eligible to also receive a grant.

If I get an EIDL and/or an Emergency Economic Injury Grant, can I get a PPP loan?

Whether you’ve already received an EIDL unrelated to COVID-19 or you receive a COVID-19 related EIDL and/or Emergency Grant between January 31, 2020 and June 30, 2020, you may also apply for a PPP loan. If you ultimately receive a PPP loan or refinance an EIDL into a PPP loan, any advance amount received under the Emergency Economic Injury Grant Program would be subtracted from the amount forgiven in the PPP. However, you cannot use your EIDL for the same purpose as your PPP loan. For example, if you use your EIDL to cover payroll for certain workers in April, you cannot use PPP for payroll for those same workers in April, although you could use it for payroll in March or for different workers in April.

How do I know if my business is a small business?

Please visit https://www.sba.gov/size-standards/ to find out if your business meets SBA’s small business size standards. You will need the 6-digit North American Industry Classification Code for your business and your business’ 3-year average annual revenue.

How do I apply for an economic injury disaster loan?

To apply for an EIDL online, please visit https://disasterloan.sba.gov/ela/. Your SBA District Office is an important resource when applying for SBA assistance.

I am unfamiliar with the EIDL process, can anyone help me apply?

Yes, SBA resource partners are available to help guide you through the EIDL application process. You can find the nearest Small Business Development Center (SBDC), Women’s Business Center, or SCORE mentorship chapter at https://www.sba.gov/local-assistance/find/.

Do I have to pay for counseling and training through SBDCs, WBCs, and MBDCs?

Counseling is free and training is low-cost with these partners. The additional funds that Congress provided will help keep this possible. Mentorship through SCORE is always free.

What is a SBDC?

SBDCs are a national network of nearly 1,000 centers that are located at leading universities, colleges, state economic development agencies and private partners. They provide counseling and training to new and existing businesses. Each state has a lead center that coordinates services specifically for that state, which you can find by clicking the link above. To find out more about SBDCs, visit https://americassbdc.org/about-us/.

What is a WBC; is it only for women?

WBCs are a national network of more than 100 centers that offer one-on-one counseling, training, networking, workshops, technical assistance and mentoring to entrepreneurs on numerous business development topics. In addition to women, WBCs are mandated to serve the needs of underserved entrepreneurs, including low-income entrepreneurs. They often offer flexible hours to meet the needs of their diverse clientele. To find out more about WBCs, visit https://www.awbc.org/.

What is SCORE?

SCORE provides free, confidential business advice through our volunteer network of 10,000+ business experts. You can meet with a mentor online. Find out more here

Who do MBDCs serve?

MBDCs are a good option for minority-owned businesses (including those owned by Black, Hispanic, Asian American/Pacific Islander, and American Indian business owners), especially those seeking to penetrate new markets — domestic & global — and grow in size and scale

Why will airlines receive $29 billion in grants?

The aviation industry accounts for more than 5 percent of America’s GDP, contributing $1.6 million in economic activity and supporting nearly 11 million jobs. Aerospace manufacturing employs 2.5 million highly-trained and skilled workers nationwide. Airline traffic has fallen significantly as the American public has made the smart decision to stop traveling to avoid catching and spreading the virus. We need to ensure that those businesses that, through no fault of their own, are impacted by the coronavirus are able to retain their highly skilled workforces and not drive them to find new jobs. The $29 billion in grants will go directly towards employees’ wages, salaries and benefits. Additionally, $3 billion in grants will go towards wages, salaries, and benefits of airline contractors, like catering and ground support staff.

What other financial assistance is available to airlines and the aerospace industry?

A total of $29 billion is available in loans and loan guarantees for airlines, including $25 billion for passenger airlines, aircraft repair companies, and ticket agents. $4 billion is available in loans for cargo airlines. An additional $17 billion is available in loans and loan guarantees for businesses critical to national security, including businesses in the crucial aerospace manufacturing supply chain.

What protections are included for workers and taxpayers?

Grants dedicated to sustaining payroll for workers will be immediately available. The bill provides additional protections for workers and taxpayers by including prohibitions on stock buybacks and dividends, and limitations on executive compensation. Collective bargaining agreements will be protected and businesses will be required to retain employees. The government will also receive warrants or equity in publicly traded companies to make sure the taxpayers are protected in the event of a loan or loan guarantee default.

Do the grants and loans account for impacted small and rural communities?

The Secretary of Transportation will make decisions about scheduled air transportation service deemed necessary and is directed to consider needs of small and remote communities and the need to maintain the health care and pharmaceutical supply chains. These provisions ensure that air carriers that get grants and loans are still subject to the Secretary’s requirements to serve communities.